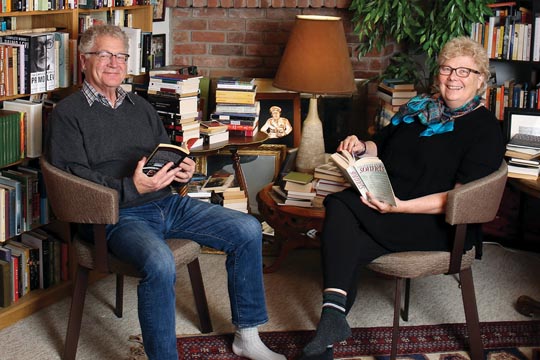

Bernice and John Klassen moved from the suburbs to a townhome-style condo in downtown Ottawa. They say if they didn’t have a cottage, they could easily live without a car.

Back in his suburban homeowner days, John Klassen had to use his car just to buy a litre of milk. No more. Klassen, who retired from what is now called Global Affairs Canada as an assistant deputy minister in 2005, and his wife, Bernice, a retired college teacher, now live in a comfortable, townhome-style condo in downtown Ottawa, with shops and services close by.

“We’re 10 minutes from the National Arts Centre and 20 from the ByWard Market,” he says. “If we didn’t have a cottage, we could easily live without a car.”

People such as the Klassens, who, in 2004, swapped their sprawling suburban home for a multi-level condo in a mature downtown neighbourhood, love the simpler condo life.

“Retirement was coming, the kids were gone, the house was at the point where we’d have to put substantial money into it,” says Klassen. “[Moving] was a lifestyle decision.”

Homework and soul-searching

Not every condo experience works out so well. Buyers can wind up in a building where units are rented as noisy Airbnbs. Condominium boards of directors, elected by unit owners to conduct the business affairs of the condo corporation, are not always responsive to other owners. Buyers sometimes realize, belatedly, that they really don’t like taking an elevator just to get outside, especially in COVID times, or that they can’t adopt a second dog.

So, homework is essential before signing on the dotted line.

“A condominium building is like a neighbourhood unto itself,” says Doug Herbert, a realtor with Royal LePage Team Realty in Ottawa. “You could have two buildings in the shadow of each other and two completely different experiences.”

And while he says almost all of his clients who make the condo switch end up happy, prospective buyers should not only check things such as the health of the condominium corporation’s reserve fund, which pays for major renovations and repairs, but also do some introspection.

“It’s an adjustment no matter what,” Herbert says. “You have to take stock of your habits, age, lifestyle, friends. The neighbourhood is very important. They may want to stay close to their social circles where that bridge game on Sunday afternoons is only a five-minute walk.”

If you’re considering a condo, don’t leave it too late, he adds. He’s seen situations where people hang onto their single-family home long past the point where they can manage it comfortably. Instead of enjoying continued independence in a condo, they wind up going directly into a seniors’ home.

Enough with the maintenance

National Association of Federal Retirees members Elida and Doug Raynor didn’t wait too long. The couple — she’s retired from the employment counselling business, he’s a retired regional manager with Public Works and Government Services Canada (now PSPC) — sold their large, single-family home and moved into a two-bedroom condo on the outskirts of Okotoks, a commuter community just south of Calgary, in early 2020.

“With the two of us rattling around inside it, it was too big. It was too ungainly for us,” says Elida, explaining her husband’s poor health meant he was no longer able to do the work around their home that he’d always enjoyed.

They paid $265,000 for their unit in a low-rise building, a little above average for a condo in the area.

She says she misses her gas range, but not shovelling snow. “I’m done with massive housework.”

Raynor adds that there’s a sense of community in her building and she feels she could reach out to a neighbour if she needed help.

Like Herbert, she cautions prospective condo buyers to do their research. She steered clear of one building after learning the board rarely met and the condo fees were unaccountably steep.

The demon of downsizing

Realizing she couldn’t fit all their possessions into the new, smaller space, Raynor did a scale drawing of the condo floorplan and then decided which furniture to discard.

“It worked out well. We were even able to add a few bonus pieces.”

Downsizing takes planning, agrees Niki Rapanos. She owns NKR Downsizing Solutions in South Surrey, B.C., one of many such services across the country.

“People don’t realize they may have to [discard] 25 to 50 per cent or more of their stuff. There’s never as much room as you think.”

Rapanos offers three top tips to downsizers:

- Start early. Even if you’re just considering a move to smaller quarters, get going now.

- Do it in small chunks, maybe an hour a day.

- Start small, perhaps in a closet. It will “train your brain” to discard so you can move onto bigger spaces.

Remember, adds Rapanos, “Downsizing is about letting go... The stuff you have represents your past. When you start letting go of some of that past, you move forward and open yourself to the future.”

Helpful condo-buying resources

If you’re like many of us, you may have last bought a home decades ago. That’s why it’s a good idea to research not just condo buying, but home-buying generally. These resources will help on both counts.

Canada Mortgage and Housing Corporation

Canadian Home Builder's Association

What you’ll pay for a condo

As you’d expect, condo prices, like other housing costs, vary widely across the country.

Along with traditional regional and local differences, the Canadian real estate market is currently in flux, with everything from housing availability to the pandemic causing prices to fall in some centres and soar in others. Nor is there unanimity among the experts on whether prices are headed up or down over the next year or so.

While reliable resale numbers are generally accessible, new condo prices are not as closely tracked in every city. As well, some reporting agencies issue monthly numbers, while others do so quarterly. In addition, some reporting agencies use a median price, which is the number where half the homes are above and half are below. Others use the average price, which is the total selling price divided by the number of homes sold. We have not distinguished between the two measurement methods.

With those caveats in place, here’s a sampling of what you’d pay for a resale or new condo in various centres as of the end of September 2020.

|

Greater Vancouver Resale $683,500 |

Calgary Resale $248,400 |

Edmonton Resale $229,172 |

Regina Resale $192,250 |

|

Winnipeg Resale $239,534 |

Greater Toronto Resale $634,756 |

Ottawa Resale $373,565 |

Montreal Resale $392,250 |

|

Charlottetown Resale $247,835 |

Greater Moncton Resale $200,300 |

Central Halifax Resale $360,671 |

St. John’s Resale $224,695 |

Sources: Canadian Real Estate Association, Altus Group, PMA Brethour Realty Group (Ottawa), others

New versus resale

You’ve decided to buy a condo. Now the question is, new or resale? There’s no definitive answer, but here are some pros and cons to each. New or resale, get a real estate lawyer to review the condo documents pre-sale. You don’t want any surprises post-sale.

New

Pros

- You choose the flooring, floor plan and upgrades.

- The down payment is spread over several months, letting you save between payments.

- Amenities such as rooftop terraces and exercise areas may be better in a new building.

Cons

- It may take two years or more for the building to be ready for you.

- You could face unexpected closing costs such as a provincial new-home warranty plan or, depending on the price, HST.

- The project could be halted entirely because of market or other conditions; you’ll get your deposits back, but you’ll be condo-less.

Resale

Pros

- Buying resale means you see exactly what you’re getting, including the space and the view.

- There’s little or no wait to move in.

- Built before land prices sky-rocketed, older condos are often roomier with more storage space.

Cons

- Customization often means renovating after you take possession.

- Standard new-home warranties may have expired.

- Condo fees and utility bills can be higher because of more maintenance and lower energy-efficiency.

This article appeared in the winter 2020 issue of our in-house magazine, Sage. While you’re here, why not download the full issue and peruse our back issues too?